I'm taking a holiday break from Pittsblog. As of January 1, 2007, Pittsblog will officially turn three years old. The 1,000th Pittsblog post will follow shortly afterward.

Enjoy what's left of the Indian Winter, and I'll see you on the flip side.

Saturday, December 23, 2006

Friday, December 22, 2006

In Which the P-G is Discovered to be a Bully

What, exactly, does Bill Toland think that I did to him? Read the Dec. 22 entry in his Casino Journal, in which he refers to "the smarty-pantses at Pittsblog."

It's bad enough that local politicians pander to Mario Lemieux. (I have absolutely nothing against Mario personally, since he's a deity and all, but he whines as well as any owner of a professional sports franchise.) It's irritating as hell to have the bigger local newspaper pandering, too.

The Isle of Capri arena plan is public money disguised as private. If it isn't, then IoC is the first enterprise in the known history of humankind to prove that there really is such a thing as a free lunch. If the P-G believes otherwise, talk to an economist or two. We have quite a talented bunch of them up in Oakland. Prove me wrong.

I can live with the fact that the Trib employs writers who don't know Journalism 101 (talk to your source before you quote him). I'm genuinely surprised that the P-G goes for name-calling. The Casino Journal doesn't do journalism, and I'm fine with that. But name-calling isn't blogging, Bill. That's typing.

It's bad enough that local politicians pander to Mario Lemieux. (I have absolutely nothing against Mario personally, since he's a deity and all, but he whines as well as any owner of a professional sports franchise.) It's irritating as hell to have the bigger local newspaper pandering, too.

The Isle of Capri arena plan is public money disguised as private. If it isn't, then IoC is the first enterprise in the known history of humankind to prove that there really is such a thing as a free lunch. If the P-G believes otherwise, talk to an economist or two. We have quite a talented bunch of them up in Oakland. Prove me wrong.

I can live with the fact that the Trib employs writers who don't know Journalism 101 (talk to your source before you quote him). I'm genuinely surprised that the P-G goes for name-calling. The Casino Journal doesn't do journalism, and I'm fine with that. But name-calling isn't blogging, Bill. That's typing.

Thursday, December 21, 2006

Cupcake Run

Dozen Cupcakes is going live on Murray Avenue tomorrow, and I'm making a cupcake run. Dozen first, then CoCo's, at lunchtime. It's time for the Cupcake Class to take to the streets!

Cupcakes and Human Capital

UPDATED: Rich Florida posted his own cupcake commentary. Check it out here.

Richard Florida emailed me yesterday to say that he enjoyed the mini-flap over the Cupcake Class. He also pointed me to this post in his own blog, which I've excerpted below. Read the whole thing for yourself.

Richard Florida emailed me yesterday to say that he enjoyed the mini-flap over the Cupcake Class. He also pointed me to this post in his own blog, which I've excerpted below. Read the whole thing for yourself.

First off, it’s important to say that there is now wide consensus among economists and other students of economic development about the primary factors that drive economic development. Long ago, Robert Solow found that technology is critically important. Today, drawing primarily upon the work of Robert Lucas, who in turn drew upon Jane Jacobs, the primary factor is seen to be human capital or what I simply refer to as talent. "As Lucas writes, “much of life is ‘creative’ in much the same way that is ‘art’ and ‘science.’ …To an outsider it even looks the same. A collection of people doing pretty much the same thing, each emphasizing his own originality and uniqueness.”

Drawing on Jacobs’ insights, Lucas, declared the multiplier effects that stem from talent clustering to be the primary determinant of growth and he dubbed this multiplier effect “human capital externalities.” He also said Jane Jacobs deserved a Nobel Prize for identifying it. Places that bring together diverse talent accelerate the local rate of economic development. When large numbers of entrepreneurs, financiers, engineers, designers, and other smart, creative people are constantly bumping into one another inside and outside of work, business ideas are more quickly formed, sharpened, executed, and—if successful—expanded. Lucas summed it up simply: “If we postulate only the usual list of economic forces, cities should fly apart.” This is because land, as Lucas reminds us, “is always far cheaper outside cities than inside.” With a penchant for common sense that seems to distinguish the greatest thinkers he sums it up with the question: “What can people be paying Manhattan or downtown Chicago rents for, if not to be around other people?”

Out with the Old?

Harold Miller has a long "is too" post up arguing that MANUFACTURING (his word) is too really, really important to Pittsburgh's future. Read the whole thing.

I did, and I'm unimpressed. Here's why: The new manufacturing of the 21st century (which is what Harold describes) isn't the old manufacturing that built Pittsburgh in the 19th and early 20th centuries. Today's manufacturing, here and elsewhere in the U.S., is well on its way to becoming a high wage, professionalized, small employment base economic sector. I'm not an economist, but when I hear the word "manufacturing" I think scale. Manufacturing companies come in all shapes and sizes, but until they move toward mass production, they're custom or craft builders as much as they are "manufacturers." Twentieth century manufacturing companies are potential drivers of entire economies. Today's new manufacturing is important in its own right, but (to borrow an IT/early stage company metaphor) it doesn't scale.

Some of this dialogue is just semantics; MANUFACTURING (Harold's caps) has a strong nostaglic pull on western Pennsylvania and on old industrial cities generally.

But semantics intersect with economic vectors. We use language to express how we're pushing and pulling in one direction or another. Put another way, metaphors matter, and "manufacturing" is a metaphor. Is it important to the New Pittsburgh that the region be known for its manufacturing? Harold cites Medrad as a local "manufacturing" success story. I'm as enthusiastic about Medrad as the next person, but I classify that company as "high tech medical devices." That doesn't scale, either, in a classic manufacturer's sense, but when I describe the company that way, I stop imagining "one company to save us all" and return to imaginging lots of little Medrads.

I did, and I'm unimpressed. Here's why: The new manufacturing of the 21st century (which is what Harold describes) isn't the old manufacturing that built Pittsburgh in the 19th and early 20th centuries. Today's manufacturing, here and elsewhere in the U.S., is well on its way to becoming a high wage, professionalized, small employment base economic sector. I'm not an economist, but when I hear the word "manufacturing" I think scale. Manufacturing companies come in all shapes and sizes, but until they move toward mass production, they're custom or craft builders as much as they are "manufacturers." Twentieth century manufacturing companies are potential drivers of entire economies. Today's new manufacturing is important in its own right, but (to borrow an IT/early stage company metaphor) it doesn't scale.

Some of this dialogue is just semantics; MANUFACTURING (Harold's caps) has a strong nostaglic pull on western Pennsylvania and on old industrial cities generally.

But semantics intersect with economic vectors. We use language to express how we're pushing and pulling in one direction or another. Put another way, metaphors matter, and "manufacturing" is a metaphor. Is it important to the New Pittsburgh that the region be known for its manufacturing? Harold cites Medrad as a local "manufacturing" success story. I'm as enthusiastic about Medrad as the next person, but I classify that company as "high tech medical devices." That doesn't scale, either, in a classic manufacturer's sense, but when I describe the company that way, I stop imagining "one company to save us all" and return to imaginging lots of little Medrads.

Wednesday, December 20, 2006

Let the Games Begin

When blogging about the slots license that was awarded today to PITG and its North Shore plan, there is only one thing to say -- even while Bill Toland's casino blog filters the froth from Penguins fans who can't see that public funding is public funding is public funding (that is, Plan A and Plan B are just different letters in the alphabet; either way, that arena is coming out of your pocketbook):

The race goes to the Swift.

Plan C it is. Bon voyage to the Penguins if the team can't make a buck without feeding at the public trough; Pittsburgh will be no worse for the wear in the long run. And bon appetit.

The race goes to the Swift.

Plan C it is. Bon voyage to the Penguins if the team can't make a buck without feeding at the public trough; Pittsburgh will be no worse for the wear in the long run. And bon appetit.

Teaching Entrepreneurial Thinking at CMU

Carnegie Mellon University is launching an $18 million initiative with $3 million in seed funding from the Kauffman Foundation to infuse entrepreneurship and innovation-management courses throughout the university's undergraduate curriculum. . . .

The effort will be managed through the establishment of a new Institute for the Study of Entrepreneurship, Innovation and Technological Change that will be the hub for education and research in innovation and entrepreneurship. This initiative will build on the efforts of the Donald H. Jones Center for Entrepreneurship in the Tepper School of Business. . . .

"Over the past few years, Carnegie Mellon has built up a multidisciplinary community of scholars devoted to research and advanced education in entrepreneurship and technological change," said Steven Klepper, director of the new center and the Arthur Arton Hamerschlag Professor of Economics and Social Science in Carnegie Mellon's College of Humanities and Social Sciences and the Tepper School. "The support from the Kauffman Foundation will enable us to leverage this expertise throughout the university, allowing students from all disciplines to understand and exploit the power of innovation."

Links: http://www.cmu.edu/news/featured_news0.shtml and http://www.popcitymedia.com/timnews/42cmuschool.aspx

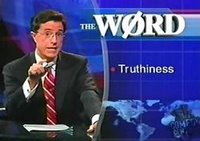

The Truthiness about the Cupcake Class

If satire has an edge, it gets lost in the explanation. But I'll have to explain, because the Tribune Review has called me out.

If satire has an edge, it gets lost in the explanation. But I'll have to explain, because the Tribune Review has called me out. Once upon a time, a man named Richard Florida lived in Pittsburgh and taught at Carnegie Mellon University and published a book called "The Rise of the Creative Class." Professor Florida argued that the future of cities like Pittsburgh lies in their ability to attract and retain members of the Creative Class -- relatively young professionals engaged in "creative" industries, who have money and taste and dynamic interests. They are, to use a more pointed phrase, David Brooks's BoBo aristocrats. Professor Florida built a lucrative consulting business and then forsook CMU and Pittsburgh for the more humid pastures of Northern Virginia. He still has a lucrative consulting business and now teaches at George Mason University.

The Creative Class hypothesis is controversial, and I'm a skeptic. My old political science professor Doug Rae, who has both worked in city government and studied urban history, calls the hypothesis "astonishingly uninformed."

What happened? Cupcakes came to Pittsburgh, and not just any cupcakes, but the kind of upscale, high-priced, elite cupcakes that appeal to BoBo Creatives. And with a prompt from Chris Briem, I christened consumers of these things "the Cupcake Class."

That's all well and good, and it's supposed to be a Floridian satire, because it should be obvious to thinking people that cupcakes and the local economy really have nothing to do with one another.

Unfortunately, the Tribune Review didn't get the joke. From today's paper:

Getting a cupcake shop can say a lot about your city, according to law professor Mike Madison and economist Chris Briem, who write about the local economy at "Pittsblog." They've speculated, semi-seriously, about "the rise of The Cupcake Class."

[quoting from this blog] "Cities that want to compete economically in the 21st century need to attract and retain The Cupcake Class: People with the time, money, and taste to consume small portions of upscale baked goods."

For the record: Actually, no. Getting a cupcake shop says little about your city, just as [here's the explanation] attracting and retaining "the Creative Class" says much, much less about urban futures than Richard Florida believes. Eventually, the cupcake fad will pass, and then losing a cupcake shop will say little about your city. Except that there were cupcake lovers once who were willing to pay $3 per cupcake, and now there are not.

The interesting economic question will be what happens to the cupcake entrepreneurs and their employees. Do they start a new business here, or do they head back to Chicago, convinced that there is no future in Pittsburgh? That would tell us something about your city.

Tuesday, December 19, 2006

Connecting the New Pittsburgh

My colleague Susan Crawford, who teaches at Cardozo Law School and who serves on the ICANN Board, has this provocative post today:

The relevance? Rails and rivers built the old Pittsburgh. What will build the New Pittsburgh?

Economic growth is tied to new ideas; new ideas are more likely to emerge online than anywhere else; so universal highspeed internet access should be a key government policy. And those private providers have every reason to skew things towards their own benefit rather than the larger social good.

Today there's a report from Australia saying -- according to MuniWireless -- that there's an association between highspeed internet access and economic growth. The report costs a good deal to access, which is unfortunate. But here's a nice summary:

This year’s report presents a compelling case for the roll-out of broadband in all regions and that it is the key driver of economic growth.

The Report found:

· the failure to address inferior Internet access quality could cost regions up to $2.7 billion in foregone gross regional products and up to 30,000 jobs in 2006;

· regions with poor access to telecommunications technology are less productive;

· firms that use the Internet can increase their sales 3.4% faster than other firms; and

· high speed broadband provides the best opportunity for Australia’s industries to access global supply chains.

The Report says that the connection of rural communities to broadband is happening ‘relatively slowly’, despite Government programs.

So -- maybe someday we'll have access to the whole report. But for the meantime it's an interesting summarized data point.

The relevance? Rails and rivers built the old Pittsburgh. What will build the New Pittsburgh?

Is the New Pittsburgh Really the Old Pittsburgh?

"Pittsburgh is still a manufacturing center. In fact, manufacturing is still the largest contributor to regional personal income (other than retirement benefits! -- see my Post-Gazette column on this a while back). In fact, I think one of the biggest problems in the region is that people erroneously think we're NOT a manufacturing center any more, and so we don't place a priority on the kinds of policies that will retain what we have and grow more of it. Moreover, I think that Pittsburgh has already gone through a process of shedding the lower-wage, lower-value manufacturing jobs that other regions have yet to go through (we lost our jobs to the sunbelt, and they will now lose them to Asia). Because of that, if we don't screw it up, manufacturing can become even more significant here in the future relative to other regions."

Interesting. I wish I had a staff -- or a grad student in labor economics; I'd like to look at some data. I still think that Harold is out in the cornfield, going against the grain. Some quick notes on his argument:

First, are manufacturing wages as a percentage of regional personal income a fair measure of whether or not Pittsburgh is a manufacturing center? That statistic doesn't tell you anything about the concentration or distribution of income, or about the number of jobs involved, or about the overall trend line for personal income. Lots and lots of assembly line jobs or a smaller number of professional jobs? You can't tell, but my money is on the latter. Is modern regional "manufacturing" is completing a shift away from the kind of commodity production that characterized Pittsburgh's earlier industrial economy? I think so. Is personal income growing or falling?

Second, manufacturing as a percentage of the current economy conceals an important and obvious change in denominator: the total dollar value of manufactured goods produced in the region. In constant dollars, I'm going to guess that this number has gone down steadily for the last 50 years, and probably longer. I'm also going to guess that this trend is pretty consistent across the Northern United States, from New England through the Mid-Atlantic and Middle West states; in other words, I don't think that Pittsburgh is a leading-edge city when it comes to the need to replenish its local economy.

Maybe I'm wrong about that (data will tell), but I have a back-up hypothesis: I'll bet that even if the dollar value of manufactured goods has remained level, or even increased, the number of regional jobs associated with producing those goods has gone down. What is manufacturing's share of total employment? I'm pretty confident that those numbers go down, down, and down over the years.

You Must Remember This

"the next page," by the way, is frequently entertaining and altogether too difficult to find. Is it too much to ask of the P-G that it remind people that the thing exists? Even create an easy-to-find web archive?

21st Century Reconstruction

Quick: Name a city, anywhere in the world, that has successfully navigated a course from de-industrialization to re-energized economy without war-related intervention.

Monday, December 18, 2006

Only Pittsburgh Can Go to China

Well, actually, lots of American cities can go to China. But Pittsburgh may actually be going: China's tentative agreement to use Westinghouse nuclear technology is a huge win for the region.

If the emotional energy in Southwestern PA followed economic logic, this deal would be the biggest story in Pittsburgh in months -- because it's far more important than Jim Balsillie's decision not to buy the Penguins, more important than Mellon Bank's being bought by the Bank of New York, and more important than the upcoming announcement regarding a slots licensee. The China deal means jobs, and a couple of thousand of them, coming to Pittsburgh.

Sure, Balsillie was going to move the team. No real loss there (seriously); losing the Pens would have meant that much less political pandering to pro sports, and less pressure to put a casino in a place where its would-be neighbors don't want it. Now that the NHL has made it clear that the team stays put, Mario is getting "fire sale" signs ready for the team's offices. There's no way that any one else will pay close to $175 million for his team, no matter what kind of arena gets built here.

Mellon Bank's leaving means that the door might be open to the "Bank of New York" arena, which sounds odd until you remember the corporate history of companies that buy naming rights to modern sports stadiums. Go ahead, make our day. Bank of New York arena it is. The only thing about the Mellon deal that I found mildly surprising was that Mellon's business ended up in New York rather than Charlotte. But if the naming thing happens, Charlotte may end up a winner anyway.

And the slots license. I haven't blogged about that issue much, but local pols treat Isle of Capri's promise to underwrite an arena as a sure thing. And any economist knows, there is no such thing as a free lunch. The proposal is taxpayer financing through the back door. Gven Pittsburgh's generally desperate financial condition, the last thing that the city needs is to mortgage what's left of its future to ice hockey. I lived in Oakland, California when city officials struck a deal to lure Al Davis and the Raiders back to Northern California. That deal stunk up public finances for years, and that was in a city that wasn't already tens of millions of dollars in debt.

If the emotional energy in Southwestern PA followed economic logic, this deal would be the biggest story in Pittsburgh in months -- because it's far more important than Jim Balsillie's decision not to buy the Penguins, more important than Mellon Bank's being bought by the Bank of New York, and more important than the upcoming announcement regarding a slots licensee. The China deal means jobs, and a couple of thousand of them, coming to Pittsburgh.

Sure, Balsillie was going to move the team. No real loss there (seriously); losing the Pens would have meant that much less political pandering to pro sports, and less pressure to put a casino in a place where its would-be neighbors don't want it. Now that the NHL has made it clear that the team stays put, Mario is getting "fire sale" signs ready for the team's offices. There's no way that any one else will pay close to $175 million for his team, no matter what kind of arena gets built here.

Mellon Bank's leaving means that the door might be open to the "Bank of New York" arena, which sounds odd until you remember the corporate history of companies that buy naming rights to modern sports stadiums. Go ahead, make our day. Bank of New York arena it is. The only thing about the Mellon deal that I found mildly surprising was that Mellon's business ended up in New York rather than Charlotte. But if the naming thing happens, Charlotte may end up a winner anyway.

And the slots license. I haven't blogged about that issue much, but local pols treat Isle of Capri's promise to underwrite an arena as a sure thing. And any economist knows, there is no such thing as a free lunch. The proposal is taxpayer financing through the back door. Gven Pittsburgh's generally desperate financial condition, the last thing that the city needs is to mortgage what's left of its future to ice hockey. I lived in Oakland, California when city officials struck a deal to lure Al Davis and the Raiders back to Northern California. That deal stunk up public finances for years, and that was in a city that wasn't already tens of millions of dollars in debt.

Saturday, December 16, 2006

Penguins on Thin Ice?

More interesting than the failure of the deal itself -- and, by the way, what sane person would buy the team now? -- is comparing the Post-Gazette's initial coverage, which concentrates on reaction from County Exec Dan Onorato and Mayor Luke, to Sports Illustrated's coverage, which emphasizes current owner Mario Lemieux. One is about pandering in local politics, the other is about sports.

Cupcake Overload

I've deleted yesterday's Cupcake Class War post; on reconsideration, I realized that it was unfair and unfunny. I obviously had one too many cupcakes. Specific apologies to Jonathan and Jefferson, who took the time to comment on it.

Enjoy the un-winter-like weekend.

Enjoy the un-winter-like weekend.

Friday, December 15, 2006

Rail Trail Completes Pittsburgh's Circle of Life

Intergalactic Law Firm

I had an interesting conversation the other day with a former colleague who still practices law with a mega firm in the Silicon Valley. He was asking about the big players in the Pittsburgh legal market. I rattled them off -- Buchanan Ingersoll, Kirkpatrick & Lockhart, Eckert Seamans, Reed Smith. Reed Smith?, he asked. He had no idea that Reed Smith -- which he knew from its Bay Area office -- was a Pittsburgh firm.

Similarly, most of Pittsburgh will yawn at the news that downtown law firm Kirkpatrick & Lockhart is merging with Seattle's Preston Gates & Ellis. What's one more 1,400 lawyer enterprise in a world of mega law? The new K&L Gates won't even be close to being the world's largest law firm -- though it might crack the top 10.

But this is interesting stuff. In business terms, this is good news. One of Pittsburgh's largest and oldest business enterprises will cease being a Pittsburgh-centric operation. It's going global. K&L is primarily East Coast and Europe. Preston, Gates & Ellis is primarily a West Coast and Pacific Rim firm. Geographically, the two firms complement each other pretty well. There will be no real geographic center of gravity. I'm told that the practices of the firms are also complementary: K&L picks up some much-needed Washington DC gravitas and antitrust expertise.

Similarly, most of Pittsburgh will yawn at the news that downtown law firm Kirkpatrick & Lockhart is merging with Seattle's Preston Gates & Ellis. What's one more 1,400 lawyer enterprise in a world of mega law? The new K&L Gates won't even be close to being the world's largest law firm -- though it might crack the top 10.

But this is interesting stuff. In business terms, this is good news. One of Pittsburgh's largest and oldest business enterprises will cease being a Pittsburgh-centric operation. It's going global. K&L is primarily East Coast and Europe. Preston, Gates & Ellis is primarily a West Coast and Pacific Rim firm. Geographically, the two firms complement each other pretty well. There will be no real geographic center of gravity. I'm told that the practices of the firms are also complementary: K&L picks up some much-needed Washington DC gravitas and antitrust expertise.

Thursday, December 14, 2006

WikiProject: Pittsburgh

The readers of City Paper have decided that Overheard in Pittsburgh is the Best Blog in town for 2006, an accomplishment that would be noteworthy if it weren't for the fact that "myspace.com" finished third.

The readers of City Paper have decided that Overheard in Pittsburgh is the Best Blog in town for 2006, an accomplishment that would be noteworthy if it weren't for the fact that "myspace.com" finished third. I didn't vote. My ballot would have shown a dead heat between the very, very serious Carbolic Smoke Blog (which gets a bullet for the name alone) and the literate and witty Tube City Online. But those might be better suited to Pittsburgh Quarterly's hypothetical list of "Best Blogs." Guess that makes me a charter member of the Cupcake Class.

O'heard is nice, but the CP profile of O'heard's author, Chris Griswold, pointed me to something that much, much better: Since late last summer, Chris has spearheaded WikiProject: Pittsburgh. A WikiProject operates within the Wikipedia enterprise. It's a volunteer effort to contribute content to Wikipedia on a specific subject. A WikiProject is member-based, but any Wikipedian can become a member. From the Scope section of WP: Pittsburgh:

This WikiProject aims to coordinate development of and improvements to articles related to Pittsburgh, Pennsylvania and the surrounding metropolitan area in Western Pennsylvania, including Allegheny, Armstrong, Beaver, Butler, Fayette, Washington, and Westmoreland Counties.

This project aims to elevate the Pittsburgh city article to Featured Article status, improve existing Pittsburgh-related articles, and create new articles for Pittsburgh-related subjects that don't have articles yet. We may also seek to create Portal:Pittsburgh.

Tres cool. The image is an icon used to recognize special efforts by an editor to improve the project.

Wednesday, December 13, 2006

Mexican Cool

Mayor Luke wants to make Pittsburgh the new cool. Is building economic ties with Mexico more likely to pay off? The city can build all the cool taxpayer-financed urban pseudo-shopping malls it likes, but unless Pittsburgh finds a way to bring more money to the region than Pittsburgh ships out, who's going to shop there?

The Cupcake Class Expands Its Territory

Yes, I may be the last to know, but the soon-to-open Dozen Cupcakes in Squirrel Hill already has some competition: CoCo's Cupcake Cafe, on Ellsworth in Shadyside, is also in the upscale cupcake business.

I've heard that Whole Foods is in this business, too, selling cupcakes for $2.75 a pop (and a four cup minimum). True? Cool. This earlier take on the East End and its environs is finally getting some traction.

I remember when $2.75 used to buy a whole gallon cake. Cupcakes came in one flavor and one flavor only. And when I wanted a drink, I got a drink, not a cupcake.

“We’ll be open late as an alternative to the bar scene,” says Mullen, a Regent Square resident whose company Good Chemistry has designed products for American Eagle and Barney's. “Ellsworth is going to rock at night--I think it’s what Walnut used to be.”

I've heard that Whole Foods is in this business, too, selling cupcakes for $2.75 a pop (and a four cup minimum). True? Cool. This earlier take on the East End and its environs is finally getting some traction.

I remember when $2.75 used to buy a whole gallon cake. Cupcakes came in one flavor and one flavor only. And when I wanted a drink, I got a drink, not a cupcake.

Monday, December 11, 2006

Meanwhile, Back at the Institute for Entrepreneurial Excellence

Yesterday, the Post-Gazette this nice Q & A [with the occasional transcription error] with the new director of the Small Business Development Center at Pitt's Institute for Entrepreneurial Excellence, Tom Juring. Tom is the second non-Pittsburgher to take over a big chunk of the IEE's economic development program in the last couple of years -- Sherry Balmat, who now runs PantherLabWorks, is the first. And Tom, like Sherry, brings to Pittsburgh a healthy dose of California-style skepticism of the "we don't do things that way" mentality.

Learning from Youngstown

Jim Russell beat me to the post with this comment on developments in and around Youngstown, Ohio:

Jim also links to this piece in yesterday's New York Times Magazine, on interesting ideas from 2006:

Something that Jim leaves implicit is something that Youngstown may be learning before Pittsburgh: The city as an urban experience may be going and gone . . . forever. The automobile and interstate highways killed city-based manufacturing and then killed downtown, and now the internet is killing them all over again. As I wrote here, after reading Douglas Rae's fabulous history of New Haven and, by extension, of the 20th century American city:

In other words, cities became cities 150 years ago because of a confluence of technological and social interests that are unlikely ever to be repeated, and cities faded during the last two-thirds of the 20th century because the techno-social tides changed gradually and eventually dramatically. We can't fight history; we can only go with the flow. Rae is the anti-Florida, someone whose instinct is to look at the historical fabric of urbanism rather than the interests of a professional [creative] elite, and someone whose argument deserves special attention in a place like Pittsburgh. Physical connectivity built cities 150 years ago. Can virtual connectivity justify them today?

Mayor Williams and his cadre of urban scientists moved into a vacuum. Youngstown has developed into a frontier geography, a fringe space, where novel ideas thrive. Cleverly, the city used the anxiety about population loss to engage citizens, activating them in the process. People are talking, but there appears to be little opposition to the renewal scheme of downsizing the city.

As word gets out that all the old bosses have left Youngstown, developers will smell opportunity. I must admit, I'm intrigued.

Jim also links to this piece in yesterday's New York Times Magazine, on interesting ideas from 2006:

At its peak, Youngstown supported 170,000 residents. Now, with less than half that number living amid shuttered steel factories, the city and Youngstown State University are implementing a blueprint for a smaller town that retains the best features of the metropolis Youngstown used to be. Few communities of 80,000 boast a symphony orchestra, two respected art museums, a university, a generously laid-out downtown and an urban park larger than Central Park. “Other cities that were never the center of steel production don’t have these assets,” says Jay Williams, the city’s newly elected 35-year-old mayor, who advocated a downsized Youngstown when he ran for office.

Williams’s strategy calls for razing derelict buildings, eventually cutting off the sewage and electric services to fully abandoned tracts of the city and transforming vacant lots into pocket parks. The city and county are now turning abandoned lots over to neighboring landowners and excusing back taxes on the land, provided that they act as stewards of the open spaces. The city has also placed a moratorium on the (often haphazard) construction of new dwellings financed by low-income-housing tax credits and encouraged the rehabilitation of existing homes. Instead of trying to recapture its industrial past, Youngstown hopes to capitalize on its high vacancy rates and underused public spaces; it could become a culturally rich bedroom community serving Cleveland and Pittsburgh, both of which are 70 miles away.

Something that Jim leaves implicit is something that Youngstown may be learning before Pittsburgh: The city as an urban experience may be going and gone . . . forever. The automobile and interstate highways killed city-based manufacturing and then killed downtown, and now the internet is killing them all over again. As I wrote here, after reading Douglas Rae's fabulous history of New Haven and, by extension, of the 20th century American city:

Cities, in other words, aren’t arguments for themselves. If you build it, they may not come, at least not in numbers sufficient to justify the investment. New Haven is like Pittsburgh, where I live now, and like dozens of other mid-sized cities that owe their former prominence to accidents of industry and now find themselves wondering what, exactly, to do next. New York is the exception that proves the rule; elsewhere else in the U.S., no one rushes downtown in the evening just to hang out with other people. And there is little, if anything, that governments can do to change things. The forces of governance are too powerful for that. City governments didn’t need to do much to sustain urban fabrics in the late 1800s. City governments don’t have the power to do so today.

In other words, cities became cities 150 years ago because of a confluence of technological and social interests that are unlikely ever to be repeated, and cities faded during the last two-thirds of the 20th century because the techno-social tides changed gradually and eventually dramatically. We can't fight history; we can only go with the flow. Rae is the anti-Florida, someone whose instinct is to look at the historical fabric of urbanism rather than the interests of a professional [creative] elite, and someone whose argument deserves special attention in a place like Pittsburgh. Physical connectivity built cities 150 years ago. Can virtual connectivity justify them today?

Virtual Pittsburgh

Jim Russell at Burgh Diaspora goes Jim Morris one better:

Connecitivty is a great watchword these days; Pittsburgh couldn't do much better. Operationalizing a "Virtual Pittsburgh" takes some doing, however. Ideas? Start with Jim (Russell)'s GlobalBurgh forum.

The Steelers connect Pittsburgh with its Diaspora, the framework for Morris' suggestion that Pittsburgh "overcome geography with the internet." Connectivity is an emerging metric for gauging economic development. The New Pittsburgh is already thriving in cities around the country. There are Austin Burgh and Raleigh-Durham Burgh, homes to Cool Pittsburgh.

Connecitivty is a great watchword these days; Pittsburgh couldn't do much better. Operationalizing a "Virtual Pittsburgh" takes some doing, however. Ideas? Start with Jim (Russell)'s GlobalBurgh forum.

Jim Morris on Valley v. Valley

CMU West Coast Dean Jim Morris has a great essay in the recent Pittsburgh Quarterly:

Read the whole thing.

I loved the Pittsburgh of the 1950s, but it’s dead. Let’s get past the denial stage of grieving and build new industries. It took 100 years for the vibrant, innovative industrial culture of Pittsburgh to run down. It took 50 years for Stanford to grow Silicon Valley from some scientific ideas. Austin, Seattle and Raleigh-Durham took comparable times to grow their industries.

Nearly 40 percent of Silicon Valley residents are between 20 and 40 while the equivalent Allegheny County cohort is 26 percent. On this point, The Economist reports a hopeful future for Pittsburgh. Its analysis deserves a fuller hearing. While we may never boom again, more students from our 34 universities are staying. In the meantime, we may find old codgers clinging to power too long while the new generation waits to step into place.

In the past 25 years Pittsburgh has tried many straight-forward steps: environmental cleanup, business-friendly university policies, state support for technology transfer, high-tech support groups, greenhouses and captive venture capital funds. They are important, but they don’t address the elusive cultural issues the generation gap presents. Here are some out-of-the-triangle ideas:

Read the whole thing.

Tuesday, December 05, 2006

The New Pittsburgh Philanthropy

As part of my occasional series on The New Pittsburgh, I've been waiting for an opportunity to write something about local philanthropic and not-for-profit communities. I found it in this sidebar to today's announcement that the merger wave in banking has finally crashed over Mellon Bank. Recipients of Mellon's foundation largesse are being assured that their financial gravy train will continue uninterrupted:

That's nice, obviously, as long as it lasts, but it raises a bigger question about the structure of local philanthropy.

Pittsburgh is legendary among cities its size for the quality of its foundation community, which I have always understood to be a legacy of the city's industrial history. The Mellon announcement underscores that belief. The not-for-profit community that is supported by those foundations, and by the elaborate fundraisers that are reported in the social section of the Post-Gazette, also strikes me as impressive. Going forward, it's clear that the not-for-profit sector of Pittsburgh has to remain vibrant and both well-supported and well-funded if the city is to have any chance of recovering and maintaining any semblance of urban vibrancy.

And yet. I wonder about the not-for-profit sector's dependence on foundation money and on big fancy fundraisers. I wonder about the sustainability of that model as big institutional donors -- individuals and foundations alike -- either leave town or decide to leave the dance, so to speak. When the checkbooks are gone, where does that leave the organizations? I don't know enough about the community to have a good sense here; I'll invite comments. Is membership and community building a strategy of choice in Pittsburgh? If it is (or even if it isn't) -- why, or why not? Does the not-for-profit sector struggle with the same inertia that characterizes so much of Pittsburgh? My sense is that it does, but I'd appreciate your thoughts.

As part of the unveiling of its merger with Bank of New York, Mellon announced the creation of a new $80 million Mellon Financial Foundation that will give out twice as much money to southwestern Pennsylvania as the previous foundation did -- $4 million a year, double the previous $2 million. It also pledged that the $1 million that it currently spends per year on area sponsorships and nonprofits will not change.

That's nice, obviously, as long as it lasts, but it raises a bigger question about the structure of local philanthropy.

Pittsburgh is legendary among cities its size for the quality of its foundation community, which I have always understood to be a legacy of the city's industrial history. The Mellon announcement underscores that belief. The not-for-profit community that is supported by those foundations, and by the elaborate fundraisers that are reported in the social section of the Post-Gazette, also strikes me as impressive. Going forward, it's clear that the not-for-profit sector of Pittsburgh has to remain vibrant and both well-supported and well-funded if the city is to have any chance of recovering and maintaining any semblance of urban vibrancy.

And yet. I wonder about the not-for-profit sector's dependence on foundation money and on big fancy fundraisers. I wonder about the sustainability of that model as big institutional donors -- individuals and foundations alike -- either leave town or decide to leave the dance, so to speak. When the checkbooks are gone, where does that leave the organizations? I don't know enough about the community to have a good sense here; I'll invite comments. Is membership and community building a strategy of choice in Pittsburgh? If it is (or even if it isn't) -- why, or why not? Does the not-for-profit sector struggle with the same inertia that characterizes so much of Pittsburgh? My sense is that it does, but I'd appreciate your thoughts.

Subscribe to:

Comments (Atom)